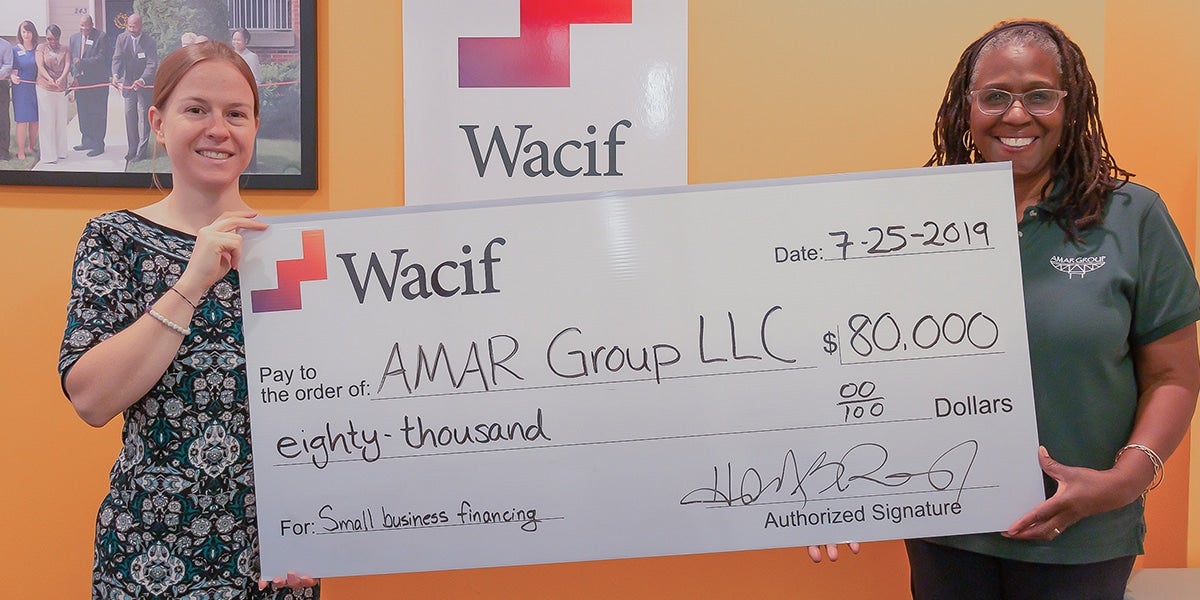

Business Financing

Finance an employee-owned business

Finding the right product for your business is essential. Our team will work with you, so you can make an informed decision that aligns with the unique goals and needs of your employee-owned business. Complete our intake form to schedule your financial consultation today.

Available Loan Products

Microloan

Loans between $5,000 – $50,000

Traditional microloans help small businesses owners and entrepreneurs build or repair credit. They also allow you to access capital in smaller amounts you can afford.

Equipment Financing

Loans between $5,000 – $50,000

The right tool for the job can make or break your bottom line. Wacif’s Equipment Financing can get your business what it needs so you can deliver for your customers.

Working Capital Term Loan

Loans between $50,001 – $150,000

Wacif’s Working Capital Term Loan takes the stress out of running your business. Rest assured you have the funds you need to run the day-to-day operations to keep your customers happy.

Contract Term Loan

Loans between $50,001 – $150,000

Wacif’s Contract Term Loan allows you to ramp up quickly by hiring staff, purchasing equipment and more. Allowing you to get to work and get the job done.

Contract Line of Credit

Loans between $5,000 – $150,000

Wacif’s Contract Line of Credit leaves you without the worry of potential cost overruns or delayed payment for work done. You’ll be able to stay focused and keep your business running smooth.

Sign up for our newsletter

Get the most up-to-date information, events, and resources to help you convert, start, grow, and finance an employee-owned business.